We hope you are enjoying the free preview of our Small Cap Report. The complete report is a comprehensive view of the small cap market and features proprietary and hard to access data from across the small cap landscape!

This report focuses on the sector and industries moves within small cap each week, then provide the top performing small cap stocks by sector as well as a Movers & Shakers list similar to our Weekly Update Movers & Sakers report. This is the perfect way for small cap investor to prepare for the week ahead.

I hope you are enjoying the 1035 Capital free Small Cap Report. To access the other proprietary and hard to come by data, upgrade to a paid subscription. Check out our free previews of the data we provide in this report! Our full update is packed with so much data that Substack can’t handle it all, so we have to send it directly from our server to your email!

Do you know anyone else who would enjoy this content? Use the share button below to show someone how much you care about their performance!

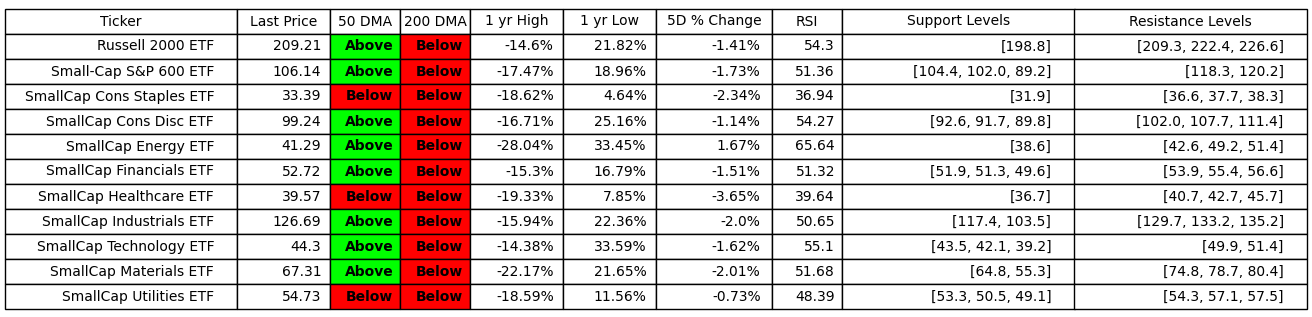

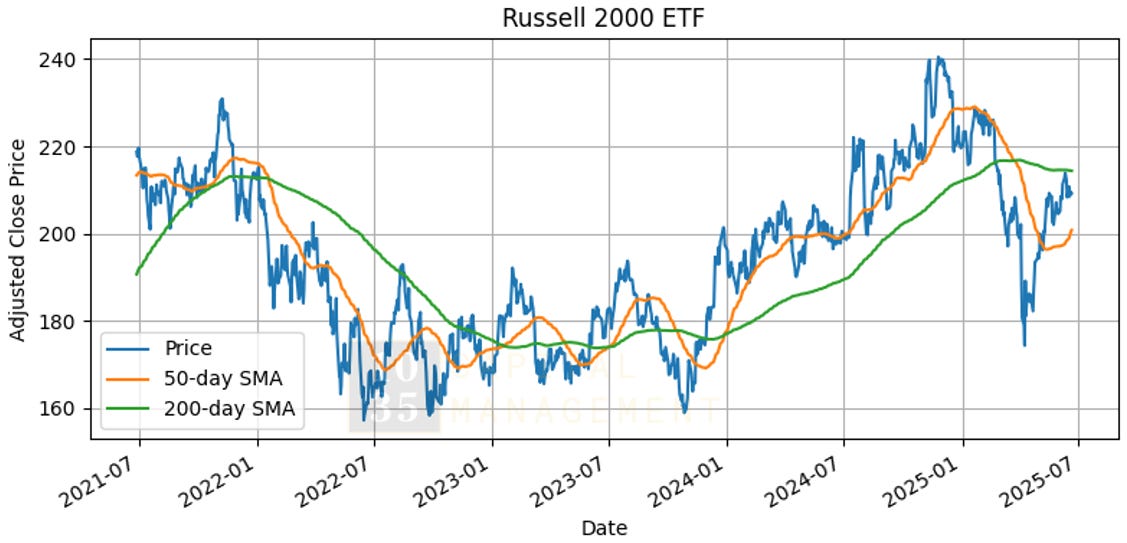

Small Cap Market at a Glance

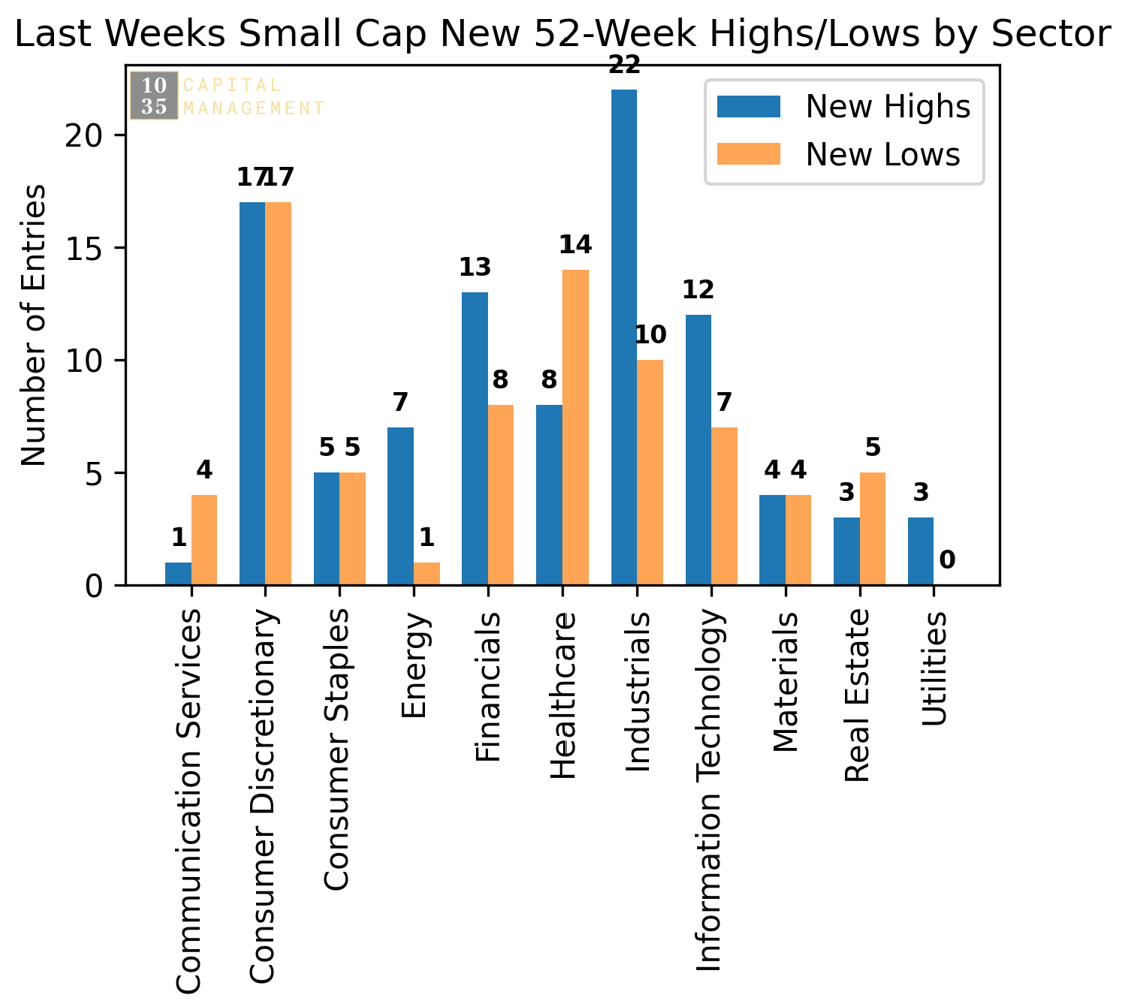

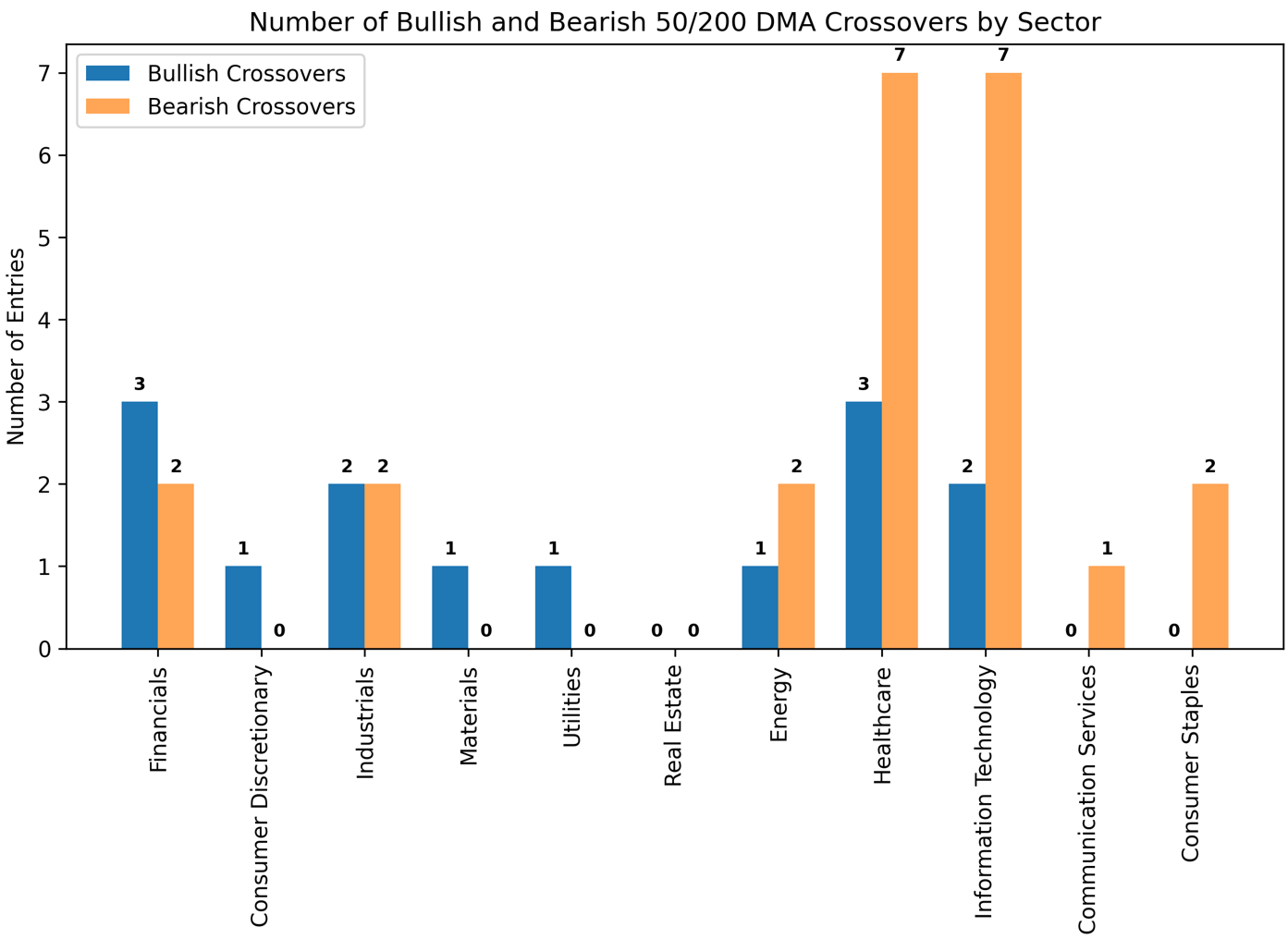

Small Cap Sector Movers

Percent of the Small Cap Index above MA

Small Cap Sector Performance (Bob’s Bingo Scores)

See below for the weekly performance of 26 Consumer Discretionary Industries.

Volatility Warnings

No significant volatility detected this week.

2 Consumer Discretionary Industries OUTPERFORMED the Russell 2000 by >3%

7 Consumer Discretionary Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Automotive_Retail

Weekly Relative Return: 14.49%

Number of Tickers: 6

Ticker List: $EVGO $CRGE $VLTA $TA $CASY $MNRO

Bottom Industry This Week

Industry: Textiles_Apparel_and_Luxury_Goods

Weekly Relative Return: -7.39%

Number of Tickers: 28

Ticker List: $ANF $HBI $COLM $VNCE $VRA $CULP $UAA $MOV $GIII $UFI $FOSL $KTB $PVH $OXM $ZGN $CRI $AEO $EXPR $TLYS $DBI $CTRN $ZUMZ $CHS $URBN $VSCO $JILL $CURV GES 0.00%↑

See below for the weekly performance of 6 Consumer Staples Industries.

Volatility Warnings

No significant volatility detected this week.

0 Consumer Staples Industries OUTPERFORMED the Russell 2000 by >3%

0 Consumer Staples Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Food_Products

Weekly Relative Return: 1.95%

Number of Tickers: 25

Ticker List: $SOVO $THS $FDP $FARM $NOMD $OTLY $DOLE $LMNR $AVO $JJSF $LANC $ALCO $BHIL $HAIN $SENEA $TR $BGS $UTZ $CVGW $CALM $BYND $JBSS $AGRO $BRCC $STKL

Bottom Industry This Week

Industry: Food_and_Staples_Retailing

Weekly Relative Return: -2.87%

Number of Tickers: 13

Ticker List: $SPTN $APRN $WMK $DDL $VLGEA $IMKTA $UNFI $GO $SFM $NGVC $PSMT $CHEF $ANDE

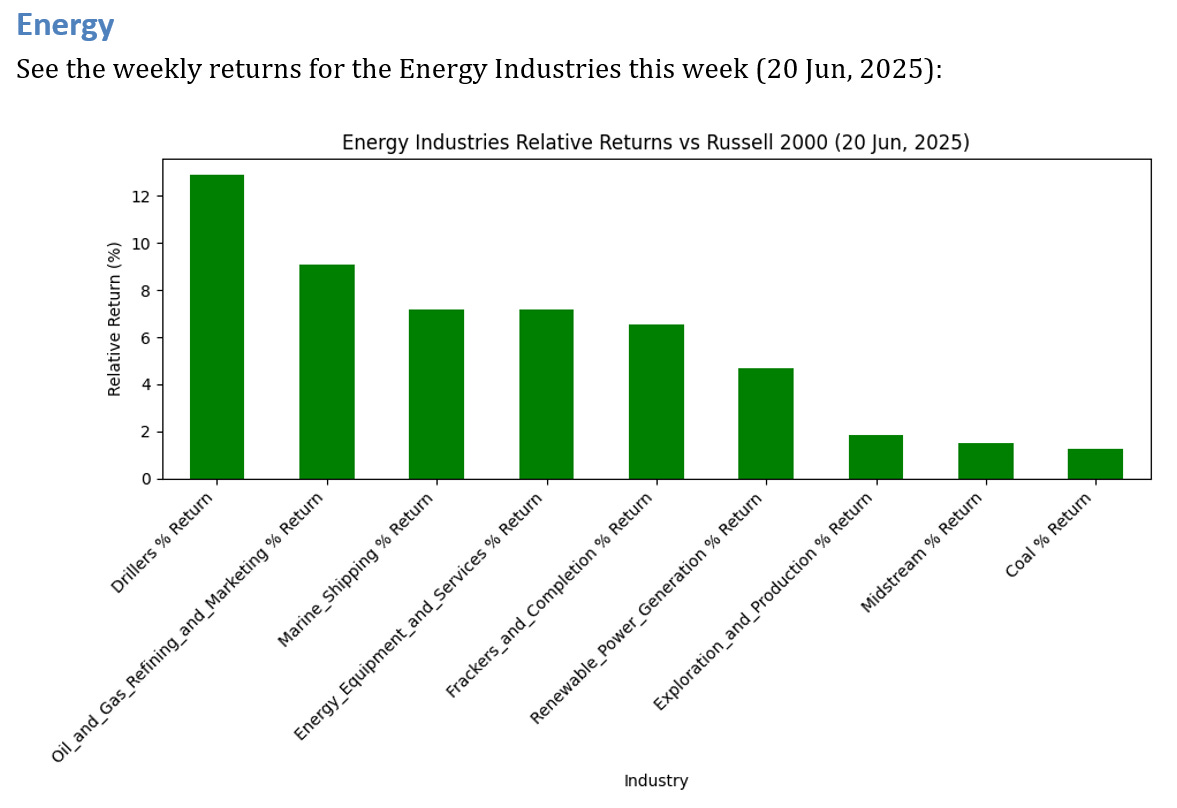

See below for the weekly performance of 9 Energy Industries.

Volatility Warnings

Warning: 6 industries OUTPERFORMED, 1 std dev above mean (2.2)

6 Energy Industries OUTPERFORMED the Russell 2000 by >3%

0 Energy Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Drillers

Weekly Relative Return: 12.92%

Number of Tickers: 11

Ticker List: $HP $OIS $NE $PTEN $VAL $RNGR $DO $XPRO $RIG $FET $NBR

Bottom Industry This Week

Industry: Coal

Weekly Relative Return: 1.25%

Number of Tickers: 9

Ticker List: $NC $ARCH $NRP $BTU $ARLP $METC $AREC $AMR HCC 0.00%↑

See below for the weekly performance of 20 Financials Industries.

Volatility Warnings

No significant volatility detected this week.

Insurance_Brokers % Return

-3.55

0 Financials Industries OUTPERFORMED the Russell 2000 by >3%

1 Financials Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Real_Estate_Management_and_Development

Weekly Relative Return: 2.3%

Number of Tickers: 26

Ticker List: $HHC $OPEN $RMAX $HOUS $STRS $DOUG $DOMA $RDFN $ARL $FRPH $COMP $MMI $ASPS $FOR $TCI $FPH $NMRK $SRG $CWK $KW $JOE $WE $OPAD $XIN $TRC $AXR

Bottom Industry This Week

Industry: Insurance_Brokers

Weekly Relative Return: -3.55%

Number of Tickers: 4

Ticker List: $SLQT $BRP $WDH GSHD 0.00%↑

See below for the weekly performance of 9 Healthcare Industries.

Volatility Warnings

No significant volatility detected this week.

2 Healthcare Industries OUTPERFORMED the Russell 2000 by >3%

1 Healthcare Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Life_Sciences_Tools_and_Services

Weekly Relative Return: 5.0%

Number of Tickers: 11

Ticker List: $ADPT $AZTA $LAB $CTKB $PACB $TXG $CDXS $MRVI $ABCL $AKYA $STVN

Bottom Industry This Week

Industry: Health_Care_Technology

Weekly Relative Return: -6.77%

Number of Tickers: 20

Ticker List: $AMWL $CNVY $SHCR $EVH $DH $SDGR $SOPH $PHR $NH $MDRX $MPLN $SLP $HSTM $HCAT $CERT $GDRX $NXGN $BBLN $LFMD OPRX 0.00%↑

See below for the weekly performance of 12 Producer Durables Industries.

Volatility Warnings

No significant volatility detected this week.

0 Producer Durables Industries OUTPERFORMED the Russell 2000 by >3%

1 Producer Durables Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Air_Freight_and_Logistics

Weekly Relative Return: 2.81%

Number of Tickers: 5

Ticker List: $HUBG $AAWW $BEST $ATSG $FWRD

Bottom Industry This Week

Industry: Airlines

Weekly Relative Return: -5.56%

Number of Tickers: 11

Ticker List: $MESA $SAVE $UP $CPA $ULCC $ALGT $SKYW $SNCY $JBLU $HA CAAP 0.00%↑

See below for the weekly performance of 8 Technology Industries.

Volatility Warnings

No significant volatility detected this week.

1 Technology Industries OUTPERFORMED the Russell 2000 by >3%

0 Technology Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Solar

Weekly Relative Return: 5.66%

Number of Tickers: 11

Ticker List: $MAXN $JKS $ENPH $SEDG $CSIQ $SPWR $FSLR $RUN $ARRY $GNRC $SHLS

Bottom Industry This Week

Industry: Software

Weekly Relative Return: -2.73%

Number of Tickers: 109

Ticker List: $MTLS $PD $PEGA $SMWB $BLKB $INST $RNG $IREN $XPER $RAMP $FROG $SMAR $NTNX $ENV $ALRM $KLR $TDC $QTWO $EVCM $YOU $NEWR $PRGS $VRNS $EGHT $CGNT $XNET $BOX $MGIC $SNCR $ALTR $PING $MSTR $MODN $IS $SUMO $MLNK $ETWO $DSP $DMRC $MNTV $WKME $BLND $RSKD $BASE $CVLT $ALLT $NCNO $ASAN $LVOX $IDCC $SEAC $ALKT $CXM $API $FRSH $ENFN $BTRS $GREE $BTCM $TENB $USER $ESMT $AVPT $ONTF $SEMR $SPNS $LPSN $DCT $TUYA $DV $FORG $LAW $AI $ZUO $SCWX $ZETA $EXFY $ATEN $OPRA $WEAV $CWAN $CCRD $BRZE $ECOM $MAPS $RNWK $COUP $LTCH $NABL $VRNT $PRO $YEXT $TUFN $RAAS $KNBE $CCSI $WK $JAMF $CMCM $CLBT $CRNC $SPSC $KLTR $AYX $INTA $AGYS $ACIW $BL OLO 0.00%↑

See below for the weekly performance of 9 Materials Industries.

Volatility Warnings

No significant volatility detected this week.

1 Materials Industries OUTPERFORMED the Russell 2000 by >3%

1 Materials Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Steel

Weekly Relative Return: 3.39%

Number of Tickers: 12

Ticker List: $HAYN $RS $AP $ZEUS $CRS $USAP $ATI $WOR $RYI $MSB $SXC $MTL

Bottom Industry This Week

Industry: Paper_and_Forest_Products

Weekly Relative Return: -3.03%

Number of Tickers: 5

Ticker List: $CLW $RFP $SLVM $MERC LPX 0.00%↑

See below for the weekly performance of 9 REITs Industries.

Volatility Warnings

No significant volatility detected this week.

0 REITs Industries OUTPERFORMED the Russell 2000 by >3%

0 REITs Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Mortgage_REITs

Weekly Relative Return: 2.28%

Number of Tickers: 27

Ticker List: $ABR $ACR $BRMK $CIM $RITM $HASI $CMTG $MITT $TWO $LADR $GPMT $MFA $EARN $ACRE $RWT $NREF $NYMT $RC $EFC $ARI $FBRT $PMT $CHMI $BRSP $TRTX $DX $KREF

Bottom Industry This Week

Industry: Hotel_REITs

Weekly Relative Return: -0.76%

Number of Tickers: 15

Ticker List: $RLJ $BHR $PK $SOHO $HT $XHR $INN $DRH $RHP $APLE $CLDT $SHO $SVC $PEB $AHT

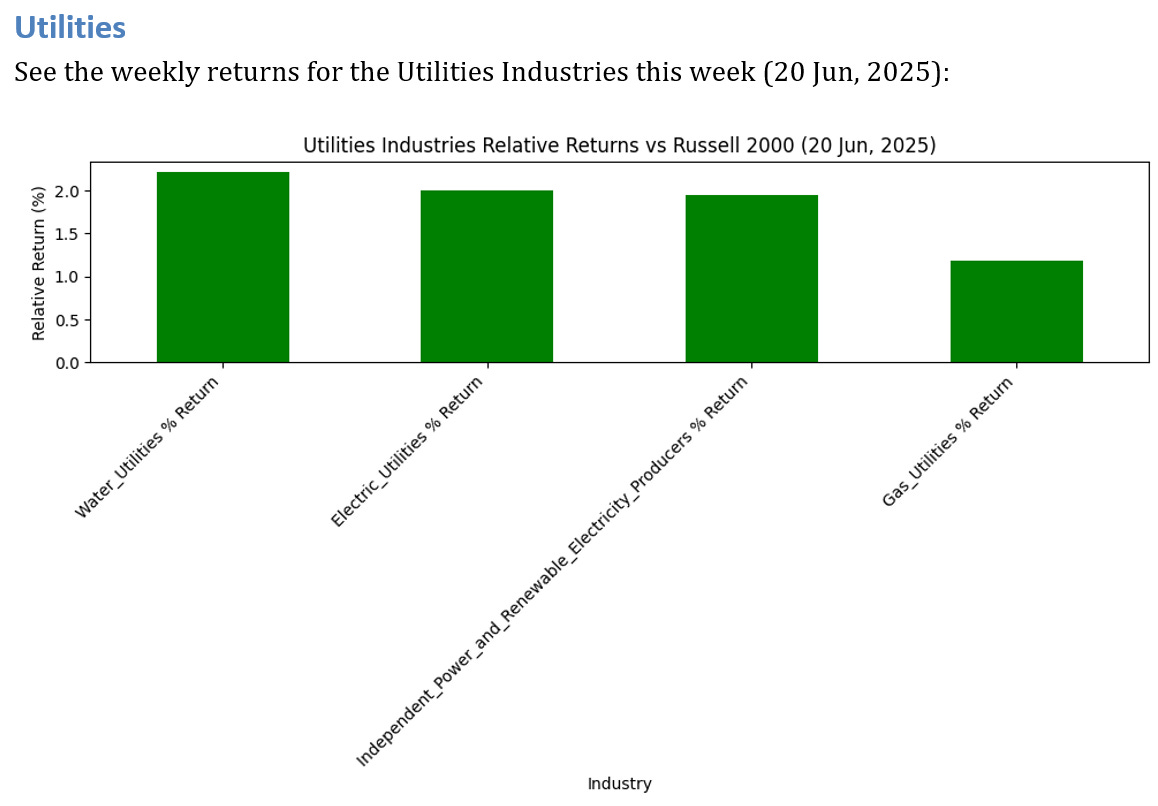

See below for the weekly performance of 4 Utilities Industries.

Volatility Warnings

No significant volatility detected this week.

0 Utilities Industries OUTPERFORMED the Russell 2000 by >3%

0 Utilities Industries UNDERPERFORMED the Russell 2000 by >3%

Top Industry This Week

Industry: Water_Utilities

Weekly Relative Return: 2.22%

Number of Tickers: 10

Ticker List: $UTL $NWE $AVA $CWCO $MSEX $ARTNA $AWR $YORW $CWT $CDZI

Bottom Industry This Week

Industry: Gas_Utilities

Weekly Relative Return: 1.19%

Number of Tickers: 7

Ticker List: $OGS $SGU $CPK $NJR $SR $SPH $NWN

Disclaimer: None of the information contained herein constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by 1035 Capital Management or its employees.